Cash discounts and tax reduction¶

Cash discounts are reductions in the amount a customer must pay for goods or services offered as an incentive for paying their invoice promptly. These discounts are typically a percentage of the total invoice amount and are applied if the customer pays within a specified time. Cash discounts can help the company maintain a steady cash flow.

Example

You issue a €100 invoice on the 1st of January. The full payment is due within 30 days, and you also offer a 2% discount if your customer pays you within seven days.

The customer can pay €98 up to the 8th of January. After that date, they would have to pay €100 by the 31st of January.

A tax reduction can also be applied depending on the country or region.

Configuration¶

To grant cash discounts to customers, you must first set up the type of tax reduction, verify the gain and loss accounts, and configure new payment terms.

Tax reductions¶

Depending on the country or region, the base amount used to compute the tax can vary, which can lead to a tax reduction.

To configure how the tax reduction is applied, go to , and in the Taxes section, in the Cash Discount Tax Reduction feature, select one of the three following options:

- Always (upon invoice)

The tax is always reduced. The base amount used to compute the tax is the discounted amount, whether the customer benefits from the discount or not.

- On early payment

The tax is reduced only if the customer pays early. The base amount used to compute the tax is the same as the sale: if the customer benefits from the reduction, then the tax is reduced. This means that, depending on the customer, the tax amount can vary after the invoice is issued.

- Never

The tax is never reduced. The base amount used to compute the tax is the full amount, whether the customer benefits from the discount or not.

Example

You issue a €100 invoice (tax-excluded) on the 1st of January, with a 21% tax rate. The full payment is due within 30 days, and you also offer a 2% discount if your customer pays you within seven days.

Due date |

Total amount due |

Computation |

|---|---|---|

8th of January |

€118.58 |

(€98 + (21% of €98)) |

31st of January |

€120.58 |

(€100 + (21% of €98)) |

Due date |

Total amount due |

Computation |

|---|---|---|

8th of January |

€118.58 |

(€98 + (21% of €98)) |

31st of January |

€121.00 |

(€100 + (21% of €100)) |

Due date |

Total amount due |

Computation |

|---|---|---|

8th of January |

€119.00 |

(€98 + (21% of €100)) |

31st of January |

€121.00 |

(€100 + (21% of €100)) |

Note

Tax grids, which are used for the tax report, are correctly computed according to the type of tax reduction you configured.

The type of cash discount tax reduction may be correctly pre-configured, depending on your fiscal localization package.

discount or not. This inevitably leads to gains and losses, which are recorded on default accounts.

the Default Accounts section, select the accounts you want to use for the Cash Discount Gain account and Cash Discount Loss account.

Payment conditions ————-=====

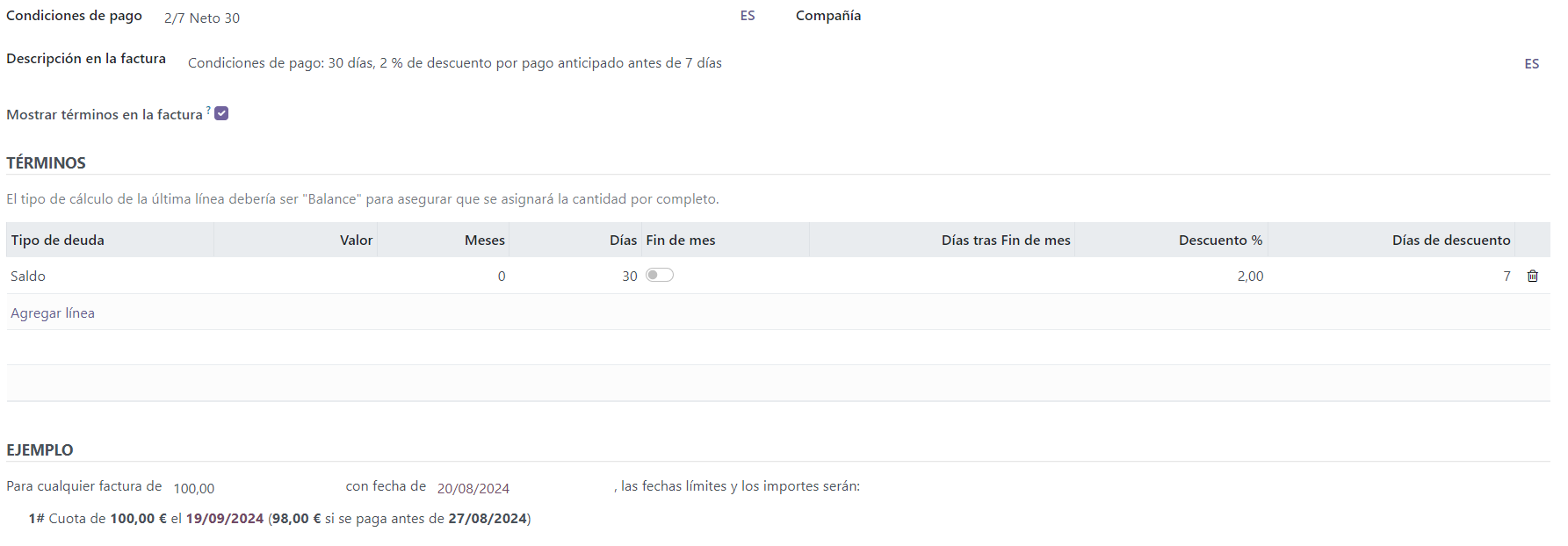

Cash discounts are defined on payment terms. Configure them to your liking by going to , and make sure to fill out the fields Discount % and Discount Days.

Apply a cash discount to a customer invoice¶

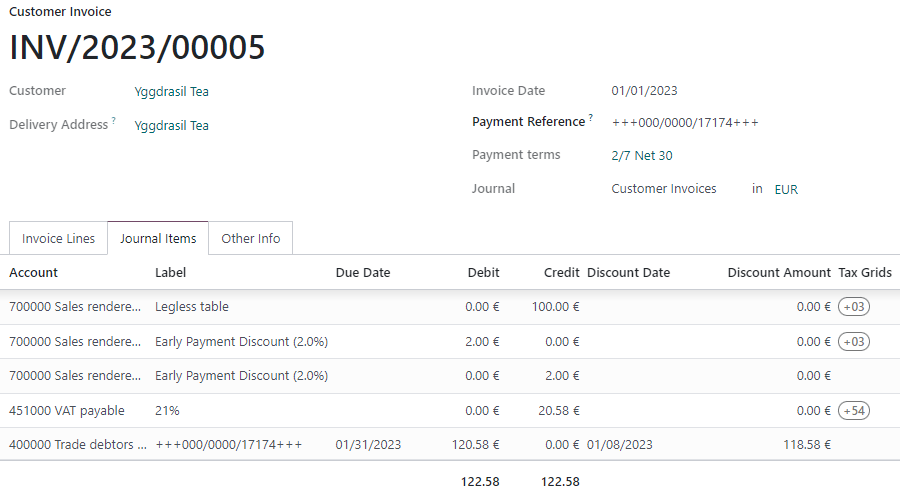

Apply a cash discount to a customer invoice by selecting the payment terms you created. Odoo automatically computes the correct amounts, tax amounts, due dates, and accounting records.

Under the Journal Items tab, you can display the discount details by clicking on the “toggle” button and adding the Discount Date and Discount Amount columns.

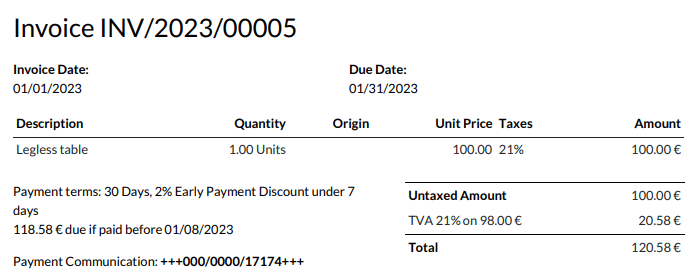

The discount amount and due date are also displayed on the generated invoice sent to the customer.

Payment reconciliation¶

When you record a payment or reconcile your bank statements, Odoo takes the customer payment’s date into account to define if they can benefit from the cash discount or not.

Note

If your customer pays the discount amount after the discount date, you can always decide whether to mark the invoice as fully paid with a write-off or as partially paid.

See also